Though new parents… Read More. UK uses cookies which are essential for the site to work. It will take only 2 minutes to fill in. If the employee does not hand in the P45 Parts 2 and 3 from the previous employer, the new employer will ask the employee to. Shared Parental Leave was created to give more flexibility to parents during the first year following birth or adoption.

| Uploader: | Kazirg |

| Date Added: | 18 September 2014 |

| File Size: | 63.86 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 37025 |

| Price: | Free* [*Free Regsitration Required] |

Skip to main content. The form P45 will also show the tax code which was operated against earnings.

Shared Parental Leave was created to give more flexibility to parents during the first year following birth or adoption. When a person leaves a job, they are given a form P45 which contains details of pay received and tax paid from 6th April that year to the date that they left dorm employment.

A non RTI employer completes section 2 and enters the code being used on the P46 before the form is sent to the Processing Office. Free representation in the event of a HMRC investigation. Find out more about who must submit this form online.

They may not have received it from their previous employer or it could have been mislaid.

UK is being rebuilt — find out what beta means. Content Writer working alongside our expert accountants to bring you the latest Tax and Accounting news. Any data collected is anonymised.

Get P45, P60 and other forms for your employees

Access to a financial advisor, o46 advisor and insurance broker. If the employee does not hand in the P45 Parts 2 and 3 from the previous employer, the new employer will ask the employee to.

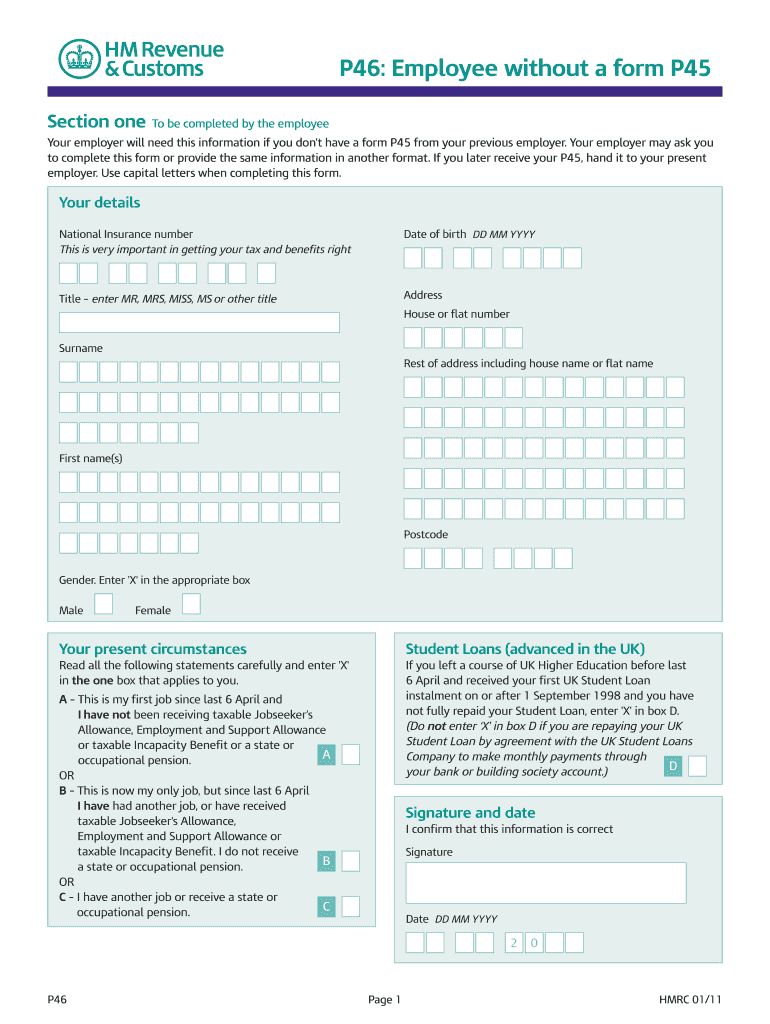

What is a P46 form? What were you doing? The person may have another job, or perhaps be a student who is just going to be employed by you during the holidays. A form P46 will help an employer to decide which tax code to operate, ensuring the employee pays the correct amount of tax.

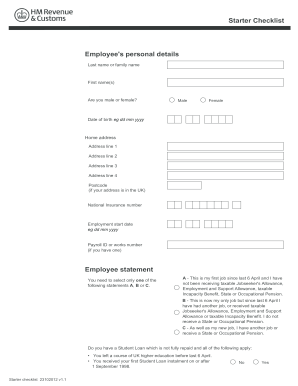

Starter checklists to replace P46 forms from April - BrightPay UK Blog

Unlimited help and advice via Skype, email, phone, live chat or in person. Completing the form enables you to operate the correct tax code for the new employee Order this form online Order this form online. Get An Instant Quote. Find out more about who must submit this form online On this page: P45, P46, etc Online filing during the year - when employees start and leave, when you start paying a pension, more Form URL Paying your employees - An overview of your obligations Overview of your obligations, from payslip and minimum wage rules to statutory payments for employees who are sick or become parents Form URL Taking on a new employee - first steps What mhrc do when you take on a new employee - including an employee who doesn't have a P45 or NI number Form URL Taking on a new employee - employee doesn't have a form P45 How to make sure you use the h,rc code - including what to do if your employee has no P45 or if the P45 is for an earlier tax year.

HMRC launch new P46 for employers - News Article London, W1 : Citycas

P46 - Employee without a form P45 Please note: Though new parents… Read More. Offices in London and Wirral for meetings with your accountant. This form will be handed in to a new employer, who will use the details on the form to ensure that the correct amount of tax is paid.

Maybe Yes this page is useful No this page is not useful Is there anything wrong with this page? Get ready for Brexit. Completing the form enables you to operate the correct tax code for the new employee.

What is a P46 form?

PDF is a file format that lets you view and print a document in a o46 which matches the look and feel of the paper version - including fonts, colours, images and layout. The statement ticked by the employee will help decide which tax code is operated hmgc their income. UK uses cookies which are essential for the site to work. A new box - Statement D - has also been added to enable former students to indicate to their employer for, make Student Loan deductions from their pay.

Automated reminders for all of your important deadlines. To view these documents you need to use a PDF file viewer such as Adobe Acrobat Reader which is available to download free of charge from the Adobe website.

There are three statements on a form P46, and the employee must tick the one that best suits their circumstances. We also have a London office.

Комментариев нет:

Отправить комментарий